2022 Fleet Industry Trends

It’s no secret that everyone is experiencing headwinds in multiple areas so in an effort not to be too redundant, our goal is to provide some perspective and helpful ways to overcome the challenges. We see the following areas that have impacted or may impact your overall fleet operations.

- Supply Chains

- Labor Shortages and Labor Rate Increases

- Fuel Costs

- Continued Leverage of Technology and Asset Management

- EV’s Continue to Gain Momentum

SUPPLY CHAIN

If you haven’t already, companies should be planning on 2022 inventory replacements. In most cases, OEM’s haven’t published fleet ordering and production schedules for the 2022/2023 model year. All immediate inventory needs will require off-the-lot purchasing and/or retail ordering which ultimately means higher vehicle pricing. While new vehicle pricing is higher so are resale values so it’s basically a new zero impact when you are replacing units. Supply chain challenges are also causing extended lead times for some vehicle maintenance repairs. In short, we expect to see continued challenges throughout 2022 but we also see it as an opportunity to leverage Onward and the fully integrated data to assist with strategic planning and make data-centric decisions.

LABOR SHORTAGES and LABOR RATE INCREASES

The great resignation is no joke. It’s becoming more and more difficult to retain current employees and we all know how challenging it is to hire new employees. I know this goes without saying but the labor shortages aren’t helping the supply chain challenges either. As for labor rates, we have seen some sudden jumps from many of our service shops in our national network of over 55,000 shops. We are seeing hourly rates range from $85 to $175 per hour. Onward strives to leverage our relationships at a local, regional and national level but we expect labor rates at vehicle service facilities to continue rising and the gap of these labor rates to tighten. There is no better time to focus on ensuring preventative maintenance is 100% compliant.

FUEL COSTS

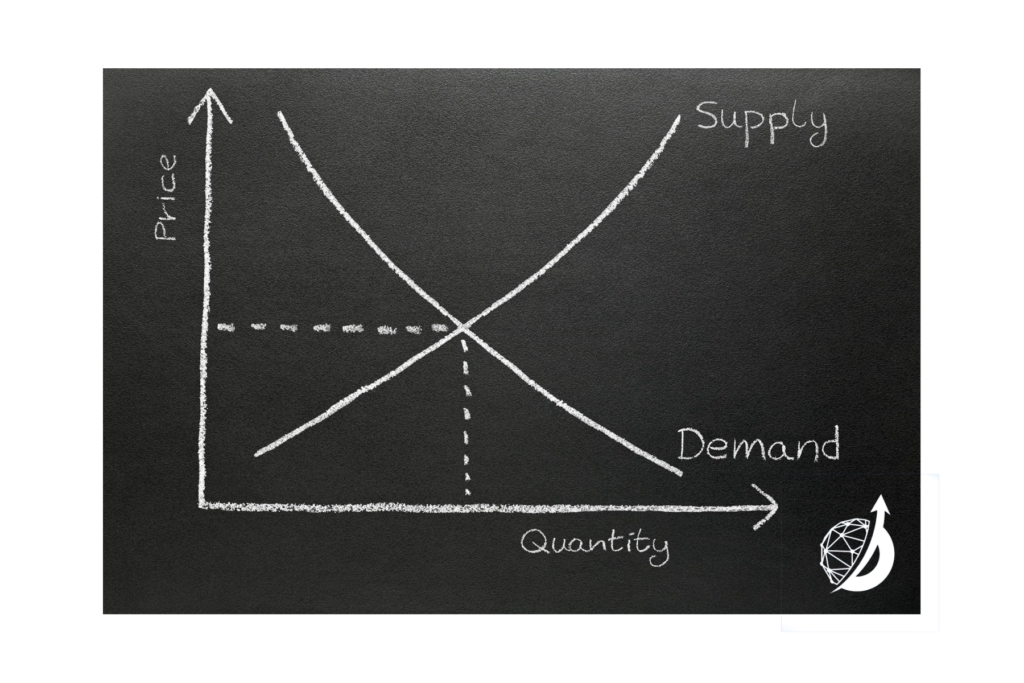

This is a great article that provides some perspective on 2022 fuel prices. In our research, we are seeing the labor and supply chain shortages making it difficult for U.S. oil companies to increase production to match the demand. Additionally, oil companies are a little hesitant about overproducing should demand have a sharp decrease. If you don’t have proper visibility into your fuel spend, we strongly encourage an assessment to help leverage resources and/or savings to keep all fuel spend optimized. We have experience with on-site fueling stations, fuel card programs that align with your company, and mobile fueling alternatives. There isn’t a “one size fits all” approach, but fuel spending is a significant part of your fleet operating costs.

TECHNOLOGY AND ASSET MANAGEMENT

In studying 2022 fleet technology trends, we are seeing new data uncovered about how the pandemic has changed the way people work. Gone are the days of using fleet technology for simple tracking. With a comprehensive telematics (GPS) strategy, Onward can help you combat the driver shortage, decrease costs, improve not only productivity but allow for a more proactive approach when it comes to maintenance. Another fleet technology trend to continue through 2022 is increased data accessibility. By utilizing one dashboard for your fleet’s data you get an overall insight into your asset’s health, driver behavior, return on investment (ROI), and total operations costs among other data points. With this additional insight, Onward can help you make data-driven decisions to reduce downtime and improve productivity for increased profitability.

ELECTRIC VEHICLES (EV’s)

2021 saw an all-time high in electric vehicle (EV) sales and, as emissions regulations continue to tighten, EV adoption is forecast to increase again in 2022. “Among the driving forces behind electrification are sustainability interests and federal, state, and local government mandates,” according to Tim Baughman, Ford Pro General Manager, North America. “Commercial customers are starting to understand that EVs are good for business, from reducing emissions to increasing sustainability, building brand value, productivity gains and a 40% reduction in operating costs as it relates to maintenance.”

Rental company Hertz has reportedly put in an order for 100,000 Teslas, half of which Uber has committed to renting for its drivers. While light-duty vehicles may seem easier to procure than medium- and heavy-duty vehicles, original equipment manufacturers (OEMs) are cranking out models for all industries, from construction and utility to long-haul and public transportation.